On June 25, 2024, China announced the new national standard for rebar -GB 1499.2-2024 (after this referred to as the new national standard) and announced that the policy would be officially implemented on September 25, with a buffer period of 3 months. According to relevant data, more than 70 steel mills in China have announced production plans for the new national standard. After September, the rebar made by the latest national standard will be put on the market.

The announcement of the new national standard has had a considerable impact on the Chinese market and has also produced many profound effects.

For this update, CSMC obtained and understood the relevant market conditions by visiting factories in various places and reading local news.

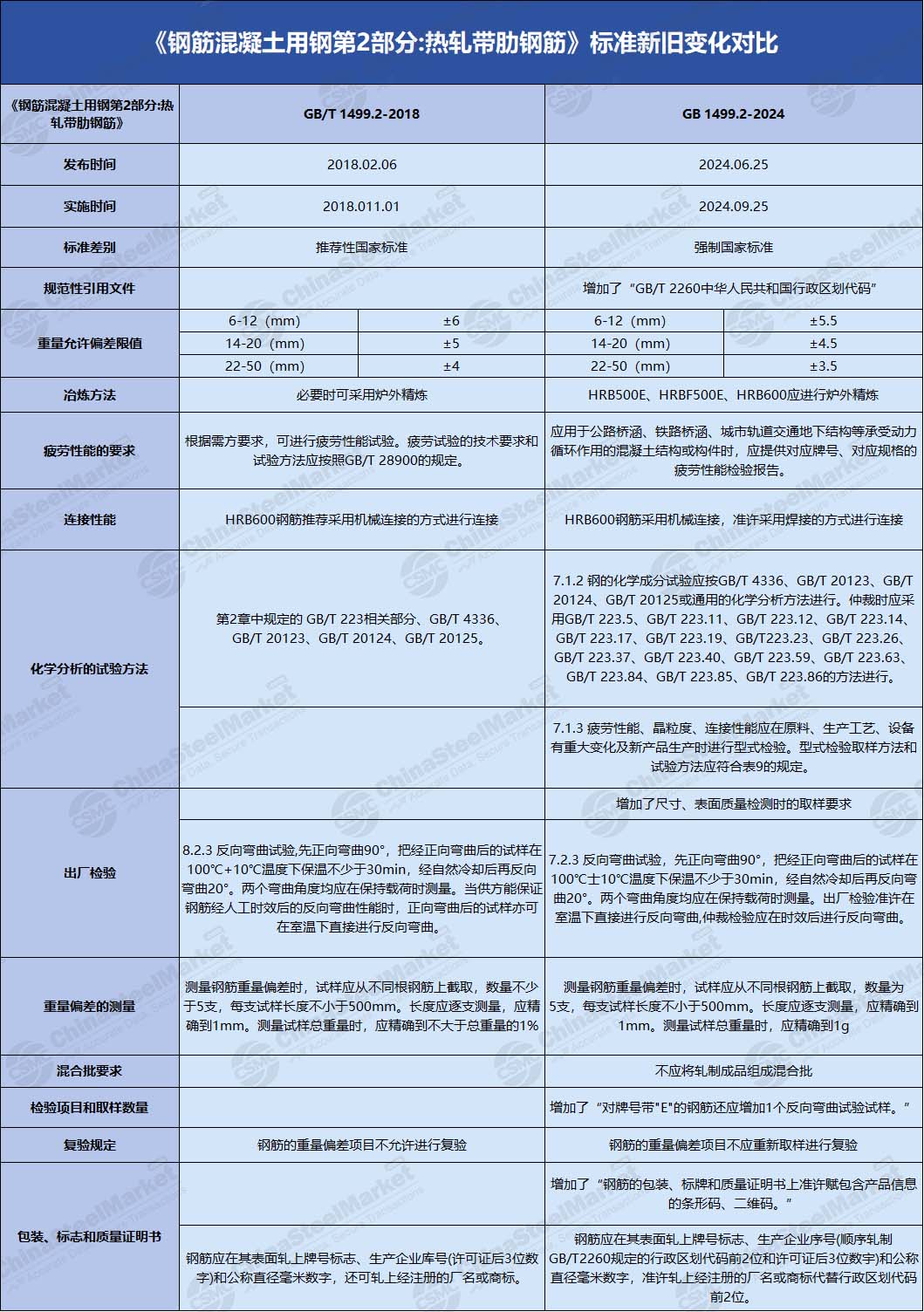

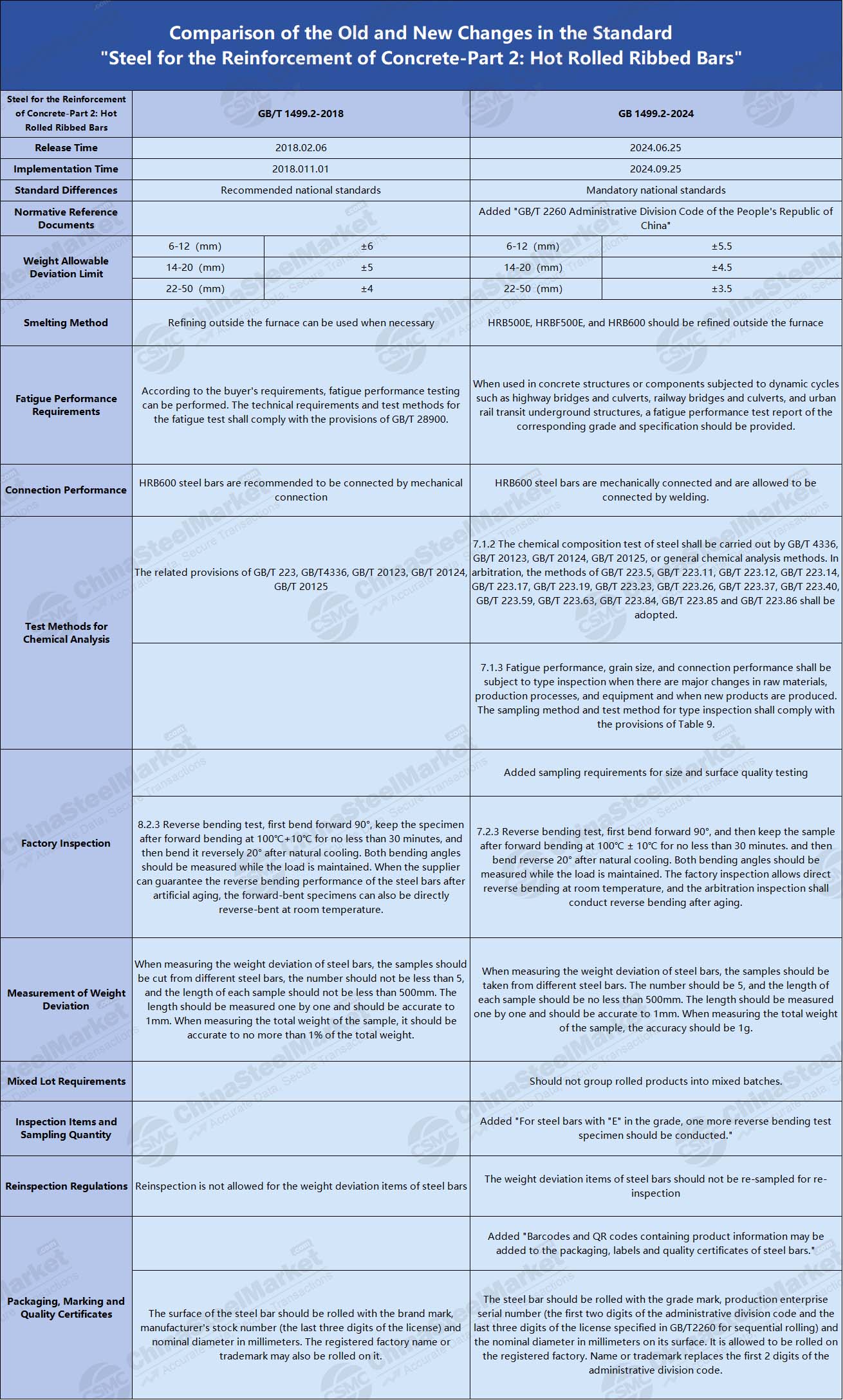

Ⅰ Comparison Between the Old and New National Standards

The main contents of this national standard update include the following points:

(1) The rebar standard has been changed from recommended to mandatory;

(2) The weight tolerance range of rebar is more stringent;

(3) The smelting requirements for high-grade rebar are more stringent, requiring refining outside the furnace;

(4) The packaging, marking, and quality certificate regulations have been changed.

Compared with the last national standard update (2018), the grace period for this national standard change has been greatly shortened, and it is a mandatory national standard. According to Article 25 of the Interpretation of the Standardization Law of the People's Republic of my country: Products and services that do not meet the mandatory standards shall not be produced, sold, imported, or provided. This means rebars meeting the old national standards may not be sold normally after September 25.

Ⅱ Impact of the Change of National Standards on the Chinese Market

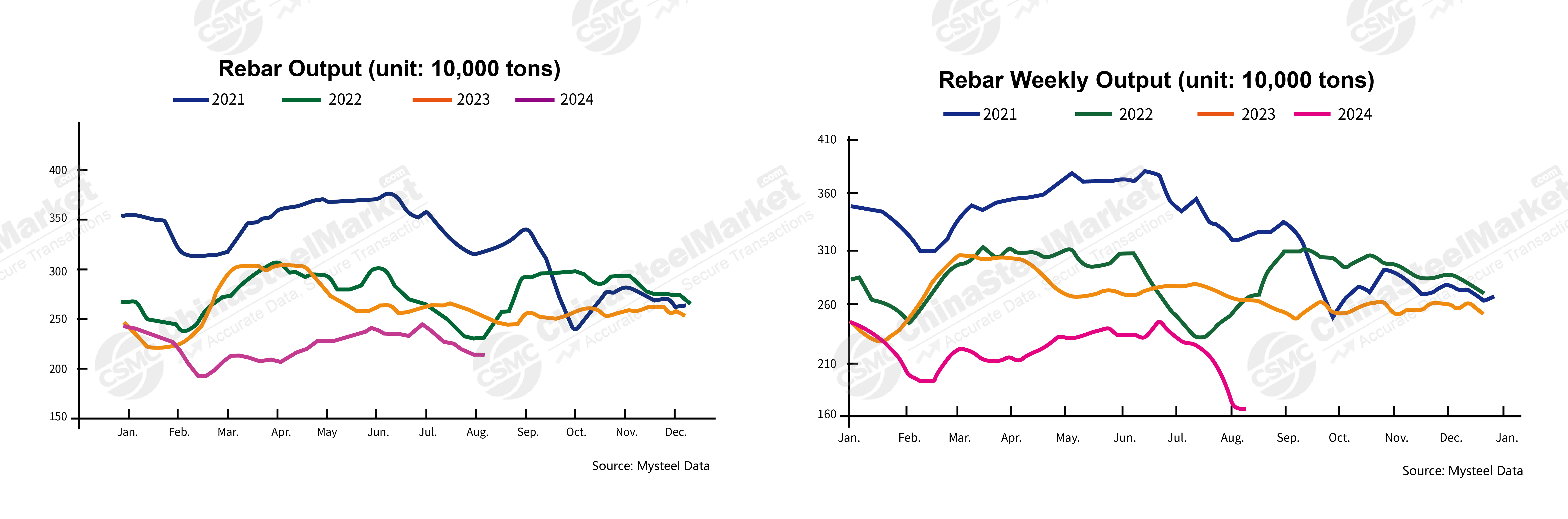

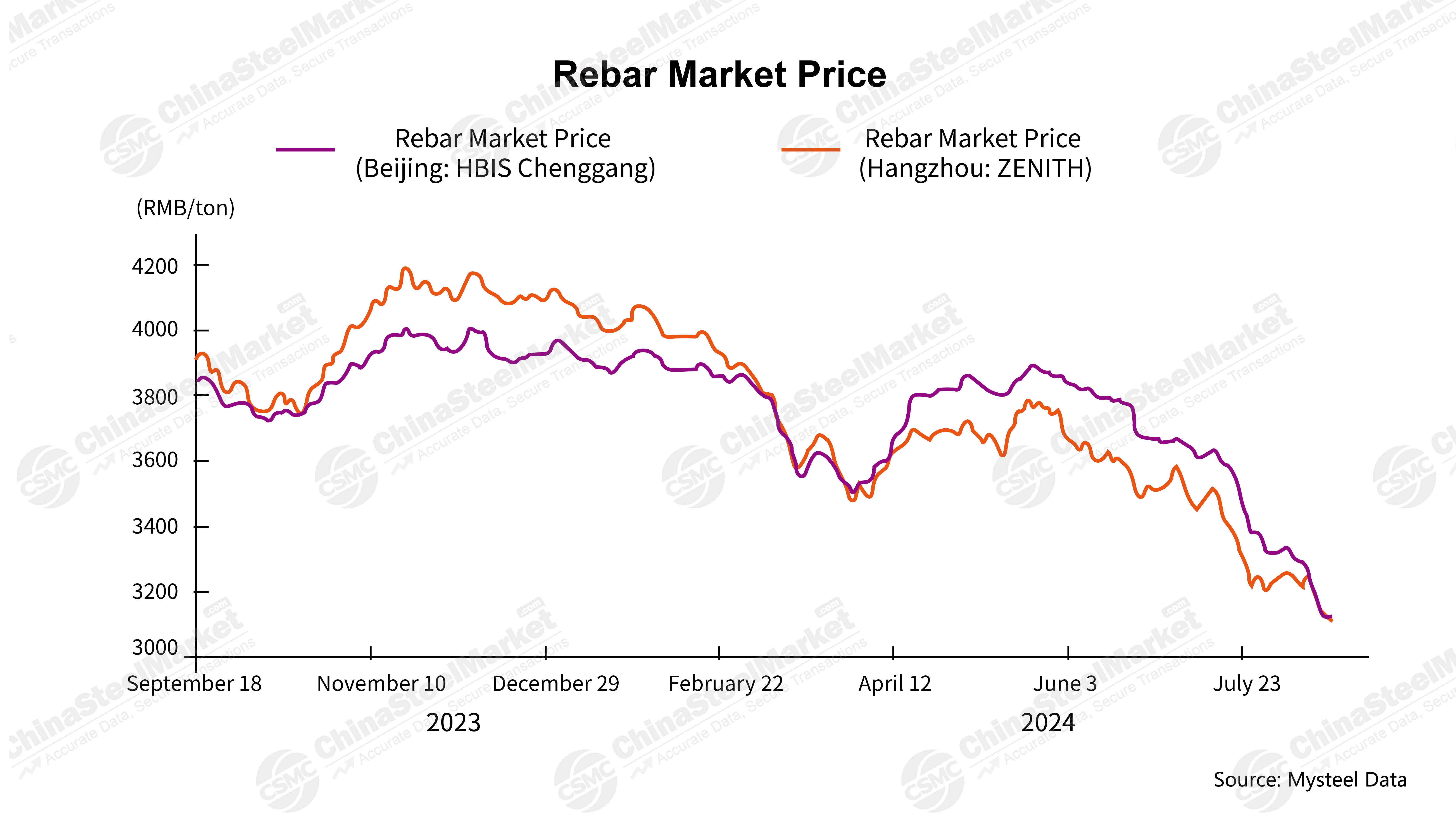

With the arrival of the traditional off-season of the steel market, the supply and demand of the steel market are weak, and the transaction of building materials is sluggish, so the overall steel price fluctuates and moves downward.

On June 25, the new national standard for rebar was announced. As the rebar market experienced a short buffer period for the conversion of the old and new national standards, the rapid decline in rebar prices and market reactions have attracted attention. Many industry insiders pointed out that the reasons for the decline in rebar prices this time are the weak market demand and panic selling due to the switch from the old and new national standards. At the same time, the continued decline in rebar prices has led to a decline in the prices of other black varieties.

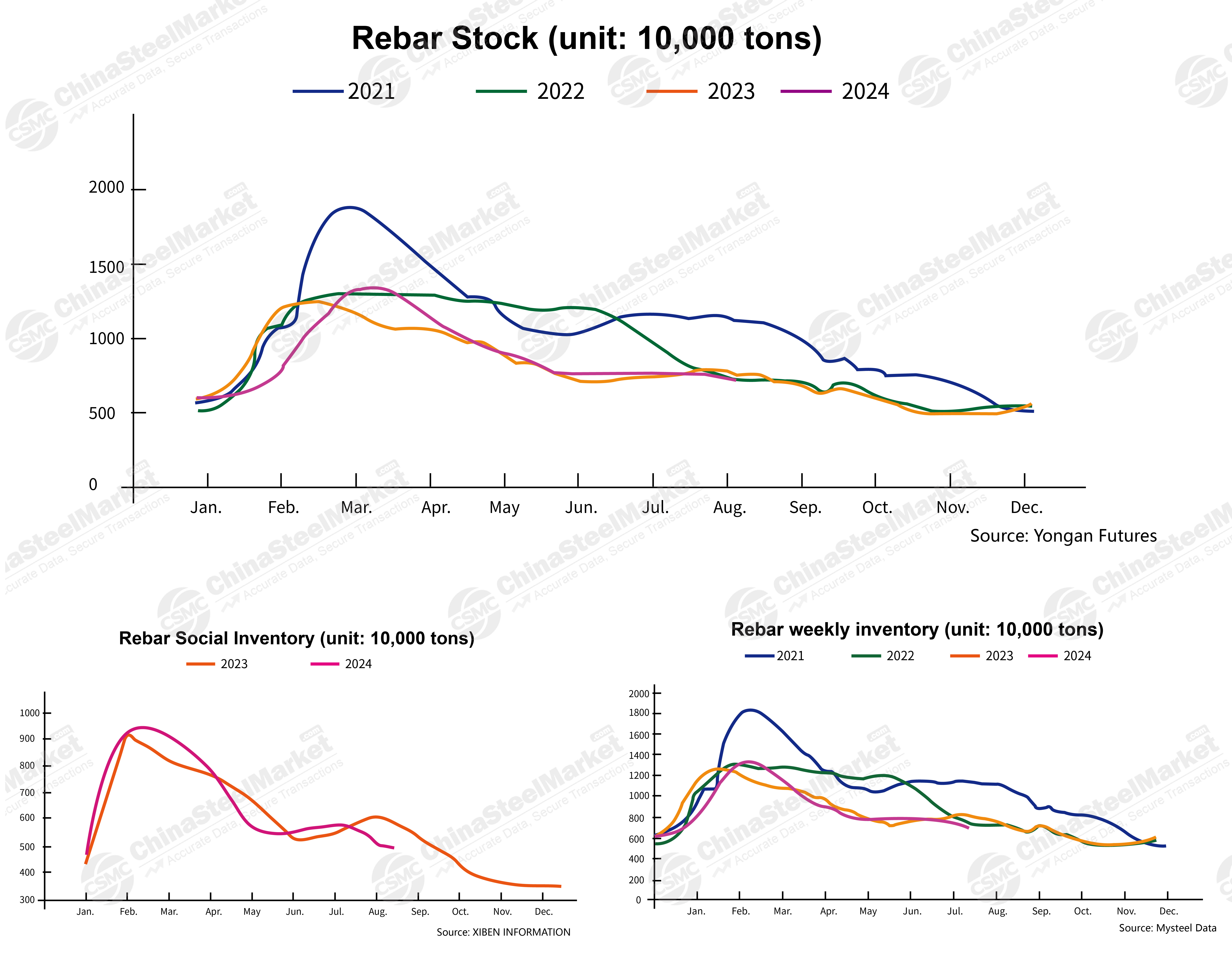

In terms of regional impact, different regions in China reacted differently to the announcement of the new national standard. First, the new national standard has little impact on the northern region. For example, Shandong steel mills have not yet issued a corresponding announcement. And the trading community has said there is no need to be overly nervous because it is normal product updates and iterations. Many markets in the north maintain a similar attitude. In the final analysis, it is because the inventory of rebar in the north is within a reasonable range, so there is not much pressure to convert.

But on the contrary, the inventory pressure in East China is relatively large, so market concerns have increased. Low-price shipments have begun to appear. According to relevant data, on July 18, the price in Changzhou fell by 16.81-19.61 US dollars per ton, and more than 2,000 tons were shipped per day. Considering the weak demand and inventory digestion problems, there is pressure on market prices in the short term. In addition, traders are worried that the shipment of old standard rebar will be hindered after the new national standard rebar enters the market circulation.

After the new national standard policy was announced, some steel mills controlled their output through maintenance and production reduction to help the contract customers smoothly pass the transition period between the old and new national standards.

A steel mill in East China reduced its daily output and its load was low, with daily output falling from 4,000 tons to less than 2,000 tons; another steel mill overhauled two rebar rolling lines since July 15, and its daily output fell to 4,500 tons.

As of July 12, the total inventory of rebar was 7.7854 million tons, steel mill inventory was 1.9401 million tons, and social inventory was 5.8453 million tons.

As of August 16, the price of rebar in Beijing was $435.71/ton, down $102.27/ton from the high point; the price of rebar in Hangzhou was $434.31/ton, down $89.66/ton from the high point. We can see that the price difference between Beijing and Hangzhou was $14.01/ton in late May. Currently, the price is at peace.

In addition to challenges and turbulence, the conversion of the old and new national standards has also brought opportunities to the steel market. First of all, a major feature of the new national standard is strictness. Whether it is stricter weight tolerance requirements for steel or revisions to other aspects such as chemical composition and mechanical performance specifications. The new national standard has made mandatory and strict requirements. To meet production requirements, on the one hand, steel mills need to improve production accuracy and quality control, increase the cost of refining processes outside the furnace, and increase testing equipment and manpower investment; on the other hand, steel mills may need to increase R&D investment to meet new technology requirements, or even update or upgrade production equipment. This means that the quality of the rebar will be greatly improved.

In the long run, the new standard is expected to promote changes in product structure and the development and application of higher-strength steel products, such as 650 MPa ultra-high-strength earthquake-resistant steel bars. It can also improve production efficiency, accurately control alloy additions, increase recycling rates, and reduce raw material consumption. In addition, the production of high-value-added products will improve overall social benefits, and the introduction of new standards will lead market demand to shift to higher-quality products. This will help accelerate the pace of steel mill upgrading and transformation, promote industrial upgrading, improve industry standards, and increase international competitiveness.

Implementing GB1499.2-2024 will undoubtedly bring profound changes to China's rebar industry. Although companies may face pressure from rising costs and market adjustments in the short term, in the long run, this standard will drive the industry toward high-quality development, which will help improve product quality and the industry's overall competitiveness.

III Impact of the New National Standard on the International Market

After the new national standard policy was announced, the most obvious change was the price. Rebar, including most hot-rolled and cold-rolled products, has significantly reduced prices. This has stimulated China's export volume to a certain extent. However, despite the recent market downturn and huge pressure to convert, many steel mills have announced that they will use the new national standard for production. According to forecasts, this low market price situation will not last long.

The new national standard will take effect on September 25, 2024, with a three-month transition period before formal implementation. The new standard is mandatory and must be implemented. Due to the short transition period, some manufacturers need to adjust their production processes, so the supply of rebar is temporarily reduced, and the price of materials that meet the standard may rise. On July 15, steel production companies such as Zenith Steel Group and Zhongxin Steel Group issued announcements on the replacement of production standards for hot-rolled ribbed and hot-rolled round steel bars.

Judging from the time of the announcement, Zhongtian Steel and Zhongxin Steel will organize the production of steel bars according to the new national standard from July 20 and August 1 respectively. It is expected that the new national standard rebar will be circulated in the market after September.

The new standard may increase the production cost of steel mills to a certain extent. On the one hand, steel mills need to improve production accuracy and quality control, increase the cost of refining process outside the furnace, and increase testing equipment and manpower input; on the other hand, steel mills may need to increase R&D investment to meet the requirements of new technologies, or even update or upgrade production equipment. The overall production cost of new national standard rebars has increased by 2.80-4.20 US dollars. From the theoretical cost point of view, compared with the old national standard, the new national standard has reduced the theoretical weight of the thread by 0.5%, so the impact on production costs is nearly 0.5%. Calculated at $490.35/ton, the impact of the new national standard on costs is only $2.45/ton. Therefore, the impact of the new national standard on prices is limited. In the short term, it is expected that the price of new national standard rebar will rise slightly. However, due to the circulation of new national standard rebar, the increase in social production capacity, and the increase in rebar inventory, the period of rebar price increase will not last too long.

The new national standard will promote the development and application of higher-strength steel products and accelerate the upgrading of China's industrial structure. This will improve the quality of Chinese rebars as a whole. Therefore, customers can buy high-quality and low-priced rebars in China.

Customers who have already made a deal or need the old version of the national standard rebar can send an email to the supplier or CSMC official customer to inquire about the specific situation. Customers who are looking forward to the new national standard products do not have to worry about supply issues. It is expected that after September, the new national standard rebar will be registered for warehouse receipts. Therefore, customers do not need to worry about the insufficient market supply of the new national standard rebar.

On July 29, the Shanghai Futures Exchange announced new delivery rules for rebar during the transition period between the old and new national standards. The new delivery rules clearly stipulate that warehouse receipts of the old national standard cannot be registered after August 19; the October contract will be delivered entirely under the new national standard. Therefore, the August and September contracts will continue to be under pressure. Although the exchange has not officially announced a ban on the production of warehouse receipts for delivery of old national standard rebar, the widening trend of the monthly price difference of rebar (especially the price difference of the 09-10 contract) has reflected the market's strong expectation that the old national standard cannot be delivered on the October contract.

From the current market situation, the early production of the new national standard rebar provides a guarantee for the stability of supply when the October contract is delivered.

As for the subsequent trend of rebar, we still need to focus on the time window for switching between the old and new national standards, the changes in total rebar inventory, and the marginal impact of market sentiment on the supply and demand fundamentals. CSMC will continue to pay attention to the follow-up content and bring you the latest information.

We sincerely hope that the information we provide can make more beneficial value. In addition, we sincerely invite you to leave valuable comments and advice on our website. We will follow your comments and advice at any time on our website.

CSMC-Empowering small and medium-scale steel purchasing.

Editor: Gianna Hana

Mail: gianna@chinasteelmarket.com

|

|

|

|

|

| Timely Info | Independent | Platform | Multiple guarantees | Self-operated storage |

| About us | Channel | Useful tools |

|---|---|---|

| About China Steel Market | Prices | Steel Weight Calculation |

| Contact Us | Answers | Why Choose Us |

| Terms & Conditions | Inventory | |

| Privacy Policy | Help |

Hot search words: